Looking Ahead: Private Markets in 2024

2023’s turbulent public market performance will live long in the memory. Global IPO activity took a nosedive while many firms suffered a drop in valuations. …

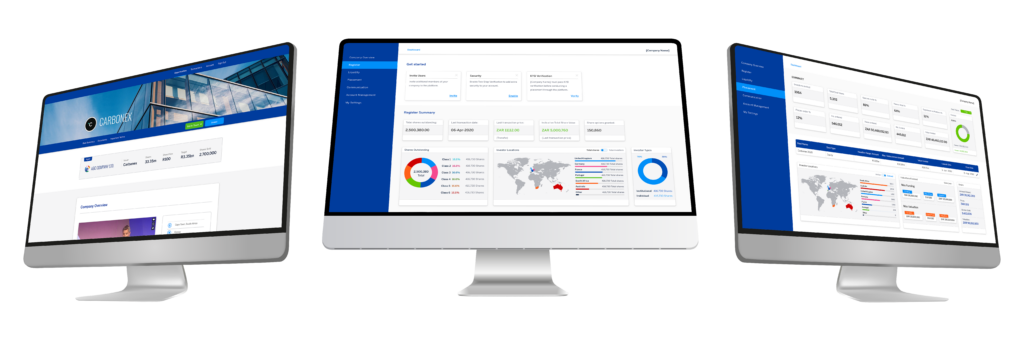

Globacap is an innovative private capital markets ecosystem that allows you to compress manual workflow processes, streamlining the execution of transactions across the investment and asset lifecycle.

Our multi-asset solution provides the digital infrastructure to execute and automate transactions from managing capital raises through to secondary liquidity across equity, debt, and fund vehicles.

Designed for private markets industry professionals, we bring public markets efficiency to private markets.

Our platform is tailored to meet the unique needs of capital raising advisers across multiple strategies and asset classes. We work with capital markets advisory firms, including:

– Corporate finance advisers

– Merchant Banks

– Investment Banks

– Venture brokers

– Private Banks

– Placement agents

– Investment networks

Streamline subscriptions into vehicles, automate capital calls, facilitate secondaries, and manage investor communications across the investment lifecycle.

– Venture Capital Funds

– Private Equity Funds

– Credit Funds

– Real Estate Managers

– Asset Managers

– Family Offices

Private markets-as-a-Service. Globacap’s platform brings your private markets strategy to market efficiently and effectively.

– Stock Exchanges

– Securities Firms

– Corporate Brokers

Utilise Globacap’s infrastructure directly to execute your capital raise, manage your cap table or execute secondaries.

Our tools allow you to automate workflows across:

Manage and execute an end-to-end capital raise across Equity, Debt and Fund vehicles.

Streamline distribution

Create feeder vehicles

Onboard Investors

Book-build

Execute & manage subscriptions

Process settlement

Client money services

Automated settlement, creating digital registries or manage existing vehicles across their lifecycle.

Maintain investor registries

View transaction history

Manage drawdowns & distributions

Track performance metrics

Manage vehicle reporting

Investor communications

Execute E-signatures and voting

2023’s turbulent public market performance will live long in the memory. Global IPO activity took a nosedive while many firms suffered a drop in valuations. …

Globacap has been recognised as one of the UK’s fastest growing tech firms by Deloitte, with revenue growth of almost 600% since 2019. Globacap ranked…

Globacap, has today announced the successful completion of a $21m Series B round of funding as the firm ramps up its drive to digitise and…