Digitising, Digitalisation and Digital Transformation: What’s the Difference?

This post is part of a series on The Digital Transformation of Private Equity: Unlocking Opportunities in Private Markets. If you’d like to download the full report, click here.

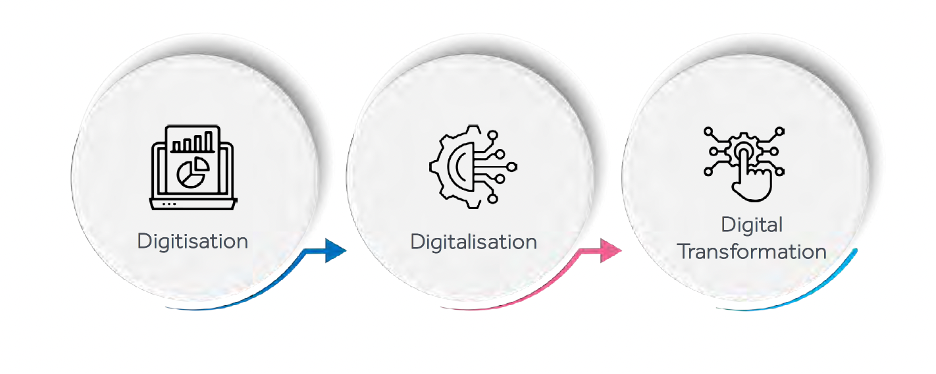

As we look at the strategic shift towards a digitally driven business model, it’s crucial to delve into the nuances that distinguish digitising, digitalisation, and digital transformation.

Digitising: the foundation

At its core, digitising involves converting analog or physical information into a digital format. While digitising primarily focuses on efficiency gains and cost reduction, it lays the groundwork for more advanced digital strategies.

Key considerations:

1. Efficiency enhancement: streamlining manual processes through automation.

2. Cost reduction: decreasing operational costs associated with manual tasks.

3. Data accessibility: improved access to digitised data, enabling faster decision-making.

Digitalisation: unlocking data potential

Digitalisation takes digitised data one step further by leveraging technology to optimise processes and enable data-driven decision-making. This involves the use of analytics, artificial intelligence (AI), and data integration to gain insights and create actionable strategies. This means harnessing data analytics to optimise investment portfolios, enhance risk assessment, and refine client engagement strategies.

Key considerations:

1. Data integration: combining data from various sources for comprehensive analysis.

2. Predictive analytics: utilising AI and machine learning to forecast trends.

3. Customer insights: enhancing client relationships through data-driven personalisation

Digital transformation: reshaping business models

Digital transformation represents the apex of the digital evolution spectrum. It involves a holistic and strategic overhaul of an organisation’s business model, culture, and operations, driven by technology, such as the adoption of blockchain

for transparent and secure transactions, or the implementation of customer-centric platforms to enhance engagement.

Key considerations:

1. Cultural shift: fostering a digital-first mindset throughout the organisation.

2. Innovation: embracing emerging technologies to create new revenue streams.

3. Agility: adapting quickly to market changes through digital capabilities.

As private equity firms contemplate their digital journey and develop, it’s essential to recognise that each phase of digital evolution serves a specific purpose and offers distinct advantages. While digitising can deliver quick wins in terms of cost reduction and efficiency, it is the integration of digitalisation and digital transformation that truly unlocks the transformative power of technology.