Digitising investment management.

Globacap’s platform meets the needs of investment managers across multiple strategies and asset classes, allowing you to automate workflow processes and optimise the execution of transactions associated with equity, debt, and fund vehicles.

Our tools streamline subscriptions into vehicles, automate capital calls, facilitate secondaries, and manage investor communications across the investment lifecycle.

Globacap Nominee Solution.

We provide Investment Managers with the ability to aggregate investors into their fund, and co-investments via our nominee vehicle.

Capture investor demand

Set investment minimums to suit your investor network, and provide a lower access point.

Free up valuable time

Significantly reduce the administrative burden of onboarding investors by outsourcing investor KYC and subscriptions.

Digitisation at its best

Digitise subscriptions into your vehicles, providing investors with a smooth experience.

End-to-end ecosystem.

Your front, middle and back-office solution to manage fundraising activity and investor engagement more effectively.

Investor aggregation

Create feeder vehicles and aggregate investors through Globacap nominee vehicles.

Investor onboarding and vehicle subscriptions

Digitise and automate subscriptions into fund, co-investment or direct vehicles.

Streamline deal distribution and LP management

Streamline deal distribution of your fund to LPs or syndicate portfolio rounds with engaging deal pages and data rooms.

Manage capital calls and distributions

Manage and automate capital calls and subscriptions using Globacap’s client money permissions.

Manage investor communications and reporting

Utilising Globacap’s registry tools to manage ongoing vehicles, track investor registries, manage investor communications and share performance reporting.

Execute secondaries

Facilitate secondary transactions in your fund or portfolio companies using Globacap’s Liquidity tool to allow easy transferability of fund, equity and debt positions.

Benefits to Investment Managers.

Drive greater productivity and better outcomes, providing your business with a competitive edge. The future of investment management.

Reduced operating overheads

Compress your workflow with one system, which can help reduce operating costs by as much as 60%.

Outsourced investor admin

Significantly reduce your administrative burden by outsourcing investor KYC and subscriptions.

Compliant investor outreach

Segment investors based on certification, geography and other bespoke tags to ensure compliant distribution.

Reallocated time and resource

Remove manual tasks and reallocation teams to focus on sourcing deals and building investor relationships.

Stronger relationships with LPs

Manage multiple offerings at once, funds, co-investments and directs and scale up transaction volume.

Improved internal and external collaboration

Collaborate easily across internal teams and third-party administrators or law firms.

Discover our solutions.

Our ecosystem

Capital Raising

Our tools allow you to streamline the distribution and execution of your placement and capital raising activities.

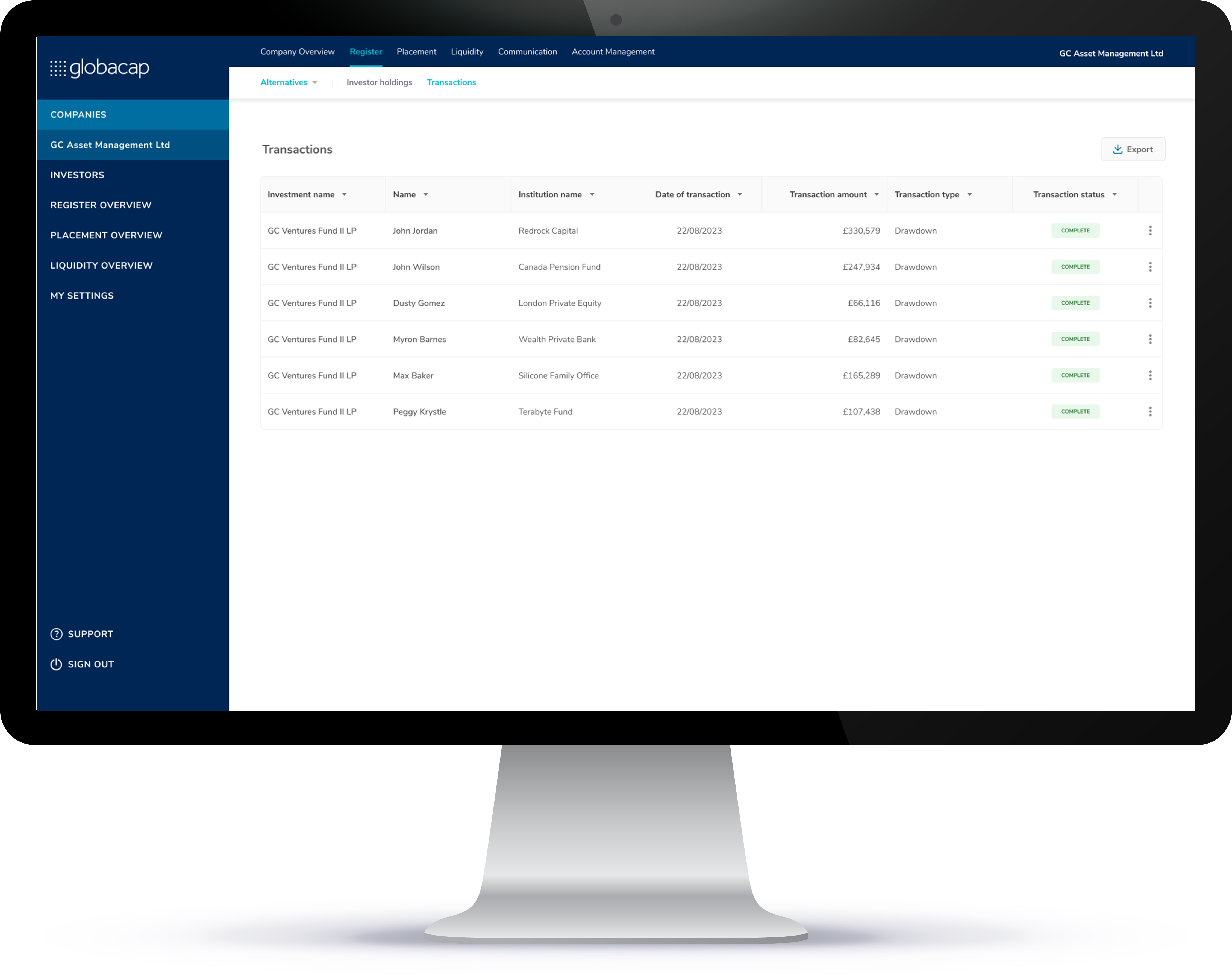

Registry Management

Our multi-asset registry tool allows you to create digital registries of your equity, debt, or fund vehicles.

Secondaries

We’ve made secondary transactions in private securities as seamless as public markets.