Distribute and manage private investments at scale.

Our platform is tailored to meet the unique needs of capital raising advisers across multiple strategies and asset classes, allowing you to efficiently segment investors, distribute deals, book build, manage client transactions and settle transactions if required.

Why Globacap?

Remove the usage of disparate systems and manual spreadsheets, providing a streamlined and centralised tool to manage your capital-raising activities.

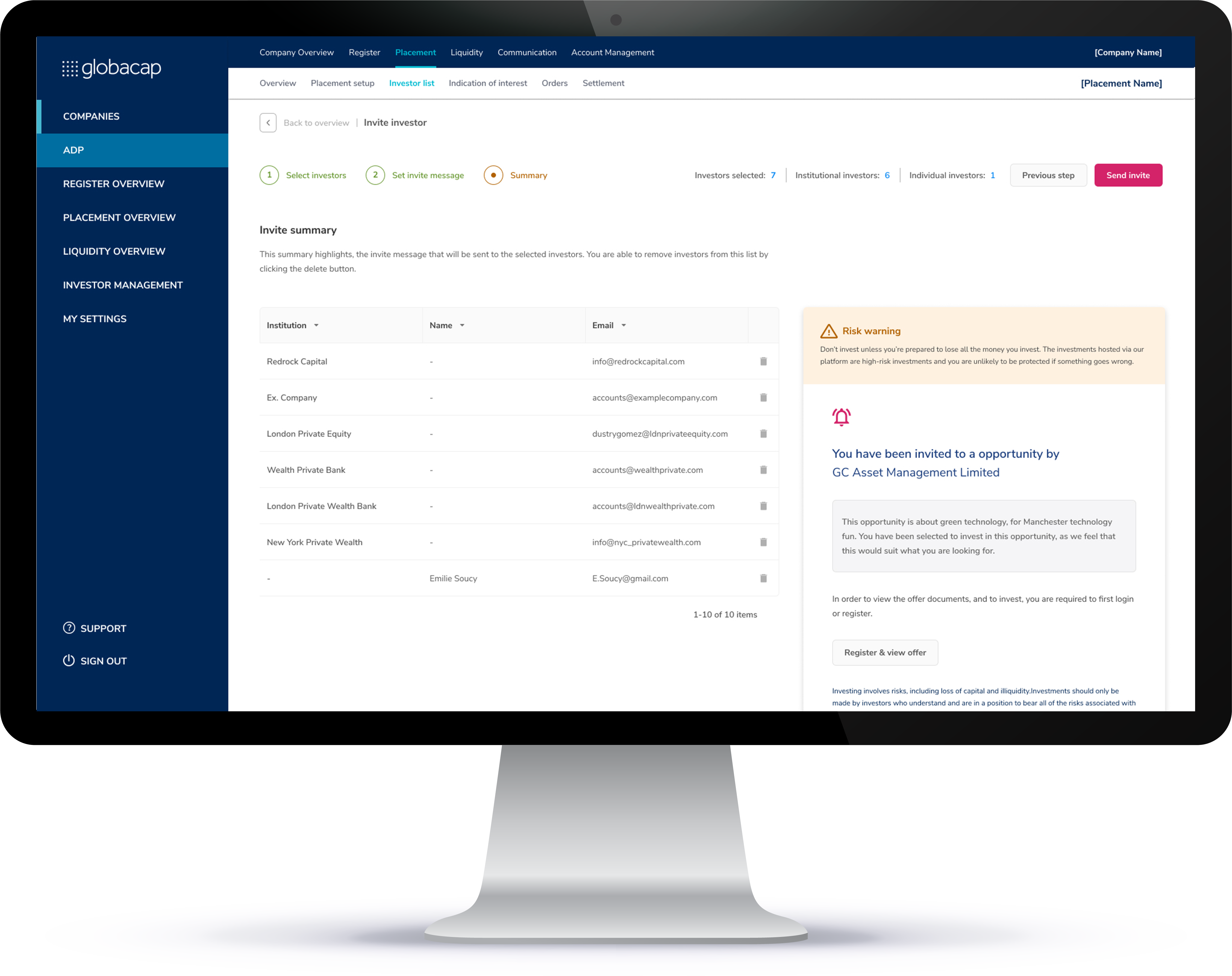

Efficiently manage and segment investors

Using our tagging tools to compliantly segment investors and quickly build distribution lists per deal.

Build deal pages and data rooms

Build customisable and engaging deal pages for investors to review deals, submit indications of interest or transact.

Track investor engagement and deal progress

Provide clients with ongoing updates on round progress with intelligent investor engagement tracking.

Extend services with settlement

Leverage Globacap’s client money permissions to offer settlement on behalf of investors.

Book build and manage indications of interest

Utilising book building tools to efficiently capture investors indications of interest and manage the capital raise.

Execute and manage subscriptions

Extend your book building processes by offering digitised subscriptions.

Benefits to Advisers

Our adviser clients can benefit from significant reductions in operational costs freeing up time to focus on winning new clients and building investor relationships.

Reduce operational costs

Replace multiple spreadsheets and disparate systems with one operating system compressing your entire workflow and reduce operating costs by as much as 60%.

Scale deal volume and widen client base

By automating repetitive tasks adviser can free up time to focus on increasing deal capacity and focus on client engagement and acquisition.

Improve competitive advantage

Improve competitive advantage and increase deal win rate with a branded investor portal, progress dashboards and ability to quickly get deals to market.

Service a wider client base

By automating many repetitive processes advisers can service a higher volume of clients, work with earlier stage clients and build a pipeline or core clients.

Improve investor relationships and engagement

Offer engaging deal pages and data rooms through a branded portal to improve investor engagement.

Refocus time on winning clients and engaging investors

Reallocate time and resources spent on repetitive administrative tasks to focus on your business and engaging with your investors.

Globacap Nominee Solution.

Globacap’s nominee vehicle can provide advisers and their clients a solution to aggregate investors into the round, allowing the network of the client to invest easily for lower minimums.

Give your clients a competitive edge

Set investment minimums to suit your investors and your clients’ networks, and allow a lower access point.

Help clients raise additional capital

Allow clients to access your wider investor base including HNW and sophisticated investors in addition to professional investors.

Free up valuable time

Significantly reduce the administrative burden of onboarding investors by outsourcing investor KYC and subscriptions.

Digitisation at its best

Digitise subscriptions into your clients’ funding round, providing investors with a smooth investor experience.

Are you ready to scale your business?

Our solutions provide you with a number of options to suit your needs.

Our ecosystem

Capital Raising

Our tools allow you to streamline the distribution and execution of your placement and capital raising activities.

Registry Management

Our multi-asset registry tool allows you to create digital registries of your equity, debt, or fund vehicles.

Secondaries

We’ve made secondary transactions in private securities as seamless as public markets.