Liquidity: Your nearest exits…

Liquidity in private equity markets is a problem that is in steady progress of being solved, thanks to the use of new technology. But how active is the secondary market, and what are the benefits to both buyers and sellers in this space?

Liquidity exists

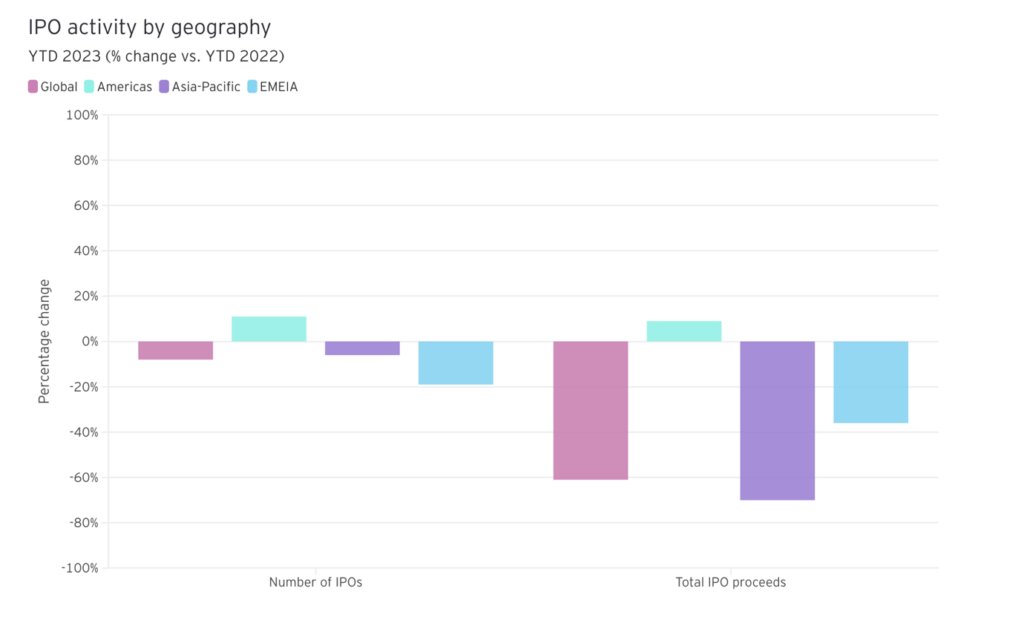

Historically, IPOs were the only real route to liquidity in private markets. But IPO volumes are down significantly in recent years. According to research from Ernst & Young, global IPO activity reduced by 42% from 2021 to 2022, and 2023 activity to date seems to be following suit.

Source: www.ey.com/en-gl/ipo.trends, Q1 2023.

However, this doesn’t mean liquidity has dried up. Far from it. Instead, investors have been able to exit positions via an alternative route to liquidity – the secondary market.

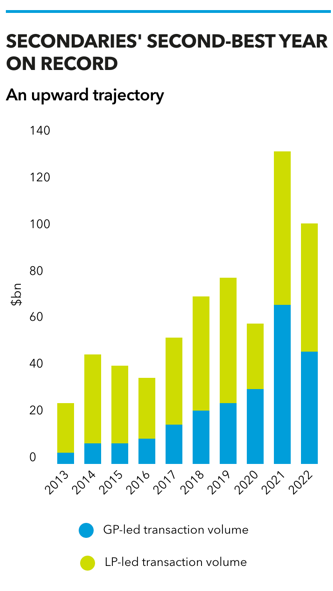

Overall, activity in the secondary market has increased substantially. This is largely expected, given the large amount of capital that has flowed into private equity markets in the past decade and the need for investors to manage exposure over time. But there are also cyclical factors at play and the current inflationary, high interest rate environment has led investors to seek out ways to rebalance and de-risk portfolios.

Secondary market volumes in 2022 exceeded $100 billion for the second year in a row (source: Evercore 2022 Secondary Market Synopsis), made up of both limited partner (LP) and general partner (GP) led transactions.

Source: Evercore 2022 Secondary Market Synopsis, published on secondariesinvestor.com.

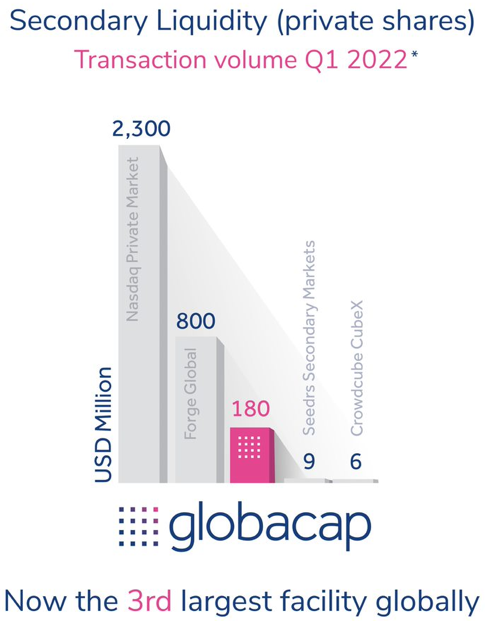

Our own data tells the same story. This time last year we were the 3rd largest facility for secondary liquidity globally, and to date, have completed US$385 million worth of transactions in the secondary market with automated settlement for our clients.

According to Private Equity International’s LP Perspectives 2023 Study , the trend looks set to continue. 22% of respondents say they are looking to sell on the secondary market and 30% are looking for buying opportunities over the next 12 months. A further 6% of respondents said they were looking to buy and sell.

The draw of the secondary market

What was once a niche part of private equity markets is becoming mainstream, as technology is allowing investors to readily realise opportunities via the secondary market. And transacting has potential benefits for both buyers and sellers alike.

Investors looking to close out positions might do so for several reasons, including:

- The opportunity to realise gains earlier than otherwise expected

- Freeing up capital to redeploy into new investment opportunities

- The ability to rebalance their portfolios and de-risk if necessary

There are also reasons that buyers of private equity might prefer opportunities in the secondary market over the primary market, including:

- Taking advantage of buying opportunities, particularly if assets are secured at a discount to NAV

- Reduced ‘blind pool’ risks, as investments trading in the secondary market will have some track record

But it is not without its challenges. Depending on how investors are accessing liquidity, it can still be complicated, expensive and administratively burdensome to transact, and valuations can be difficult to determine given limited transparency. But as the secondary market grows, the market should become more efficient and the liquidity problem for private equity should largely disappear.