What is capital markets automation?

When Henry Ford opened the world’s first moving assembly line at his Michigan plant in 1913, it was rightly hailed as a tectonic shift in the way mankind satisfied our needs and wants through technology. However, revolutionary as Ford’s innovation was, it was just the latest example of an already deeply engrained pattern where continual improvements to capital goods and industrial organisation had led to exponential increases in productivity and output.

Where Ford was special, as is so often the case with visionary entrepreneurs who create new demand and in so doing new markets, was that he was so far ahead of the crowd in comparison to his more orthodox commercial competitors. Just as it had seemed self-evident to Adam Smith that division of labour was the root cause of the productivity increases that created the possibility of capital accumulation and the Industrial Revolution in England, to Ford in the early 20th century it was equally apparent that the methods of industrial production were ripe to be overhauled.

Today, we are starting to see another great surge in technological advances, and just like those analysed by Smith or utilised by Ford, they will drive productivity and profitability to new heights.

What does automation mean for capital markets?

The word automation conjures up different images for different contexts. Even if someone didn’t have first-hand experience manufacturing plants, we are all to some degree aware of the type of high-tech industrial robotics that is essential to modern industry. This form of automation is accepted without any reservation as beneficial to all stakeholders.

At Globacap, automation means so much more than this type of industrial application alone. The potential of automation to streamline, simplify and accelerate aspects of professional services roles has as yet barely been touched. Given the dominant role of the service sector within the UK economy, the potential of automation to enhance productivity here is of huge significance.

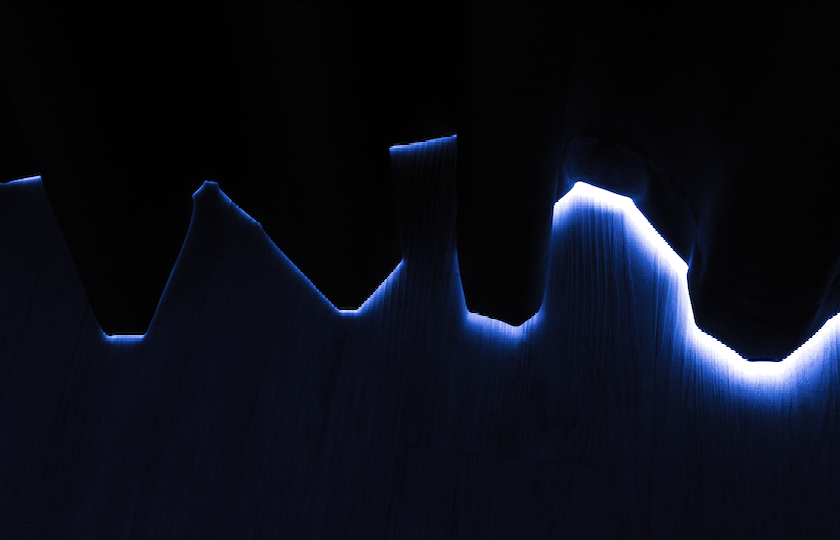

As the graph illustrates, the breadth of tasks susceptible to the inclusion of some degree of automation is extensive, and the debate is rapidly evolving in the direction of how the mix between automated and manual processes can work best in each area and for each institution.

Source: Brown Brothers Harriman

Our mission is to spread the efficiency gains from digitisation and automation to more areas of private capital markets. We believe this is to the benefit of all market participants, in the same way that automation in car production has ultimately served the interests of both consumers and producers. Whether you are a buy-side or sell-side institution, the human and financial resources that can be liberated via automation are considerable and will potentially hand early adopters an edge for years to come.

Processes ripe for automation

Automation of certain functions is not an aspiration or something that may be possible in the future. It is here today and has been applied successfully in several areas.

- Deal clearing, settlement, and securities issuance

These inter-linked areas are set for disruption from automation. Clearing and settlement processes through which accounts are updated, payments scheduled, and finally cash or securities exchanged remain frustratingly slow-moving even today. The extensive range of intermediaries and regulatory checks that need to be performed across multiple IT systems, often manually and with a large quantity of collateral paperwork, means the fundamental process has barely changed in decades. However, the prescriptive and highly technical nature of these processes means they can be fully automated, allowing investors to get their share certificates and companies get their cash swifter than ever before. As such, automation isn’t about removing or circumnavigating regulation, which is completely essential to a well-functioning market – automation is about making complying with regulation as painless and easy as possible for market participants, freeing them up to focus on what they do best.

- KYC/AML compliance

KYC/AML regulations necessitate specific documentation being viewed, stored, and verified by service providers. Currently cumbersome and time-consuming, these procedures can be codified and set up as instructions to run on platforms with relative ease. This approach saves further time and effort because investors need only be KYC’d once when they join a platform – once initially issued, clearances and approvals can be reissued as required with ease. As above, automation allows all parties to ensure and to be confident that they are fully compliant without demanding the extensive time input it currently does.

- Registry and cap table management

Capital table and share registry functions also remain remarkably slow and labour-intensive processes. Updating the internal and external registers and performing all necessary operations with regard to Companies House can consume considerable amounts of employee time. More specialised activities like issuing and keeping track of employee share-options are even more laborious. Once again this administrative burden can be almost totally removed via the use of tech that can automate the performance of these repetitive tasks. As well as saving your staff time to do more productive activities, automation means you can be highly confident that no mistakes or ‘fat finger errors’ have crept in.

Overcoming the Solow paradox

Every undergrad economics student knows Robert Solow’s famous quip that you can see the impact of the IT revolution everywhere – except in productivity statistics. The problem the Nobel prize-winning economist was alluding to back in 1987 has since been termed the Solow Paradox; arguably today we are witnessing a new iteration of this. Researchers at McKinsey have applied the concept to digitisation, citing predications that when fully harnessed such developments could boost productivity by up to 2% per annum, but that at present the full potential has manifestly not been realised.

Whilst there is broad consensus that automation of certain processes is desirable, adoption rates remain comparatively low. Are we seeing another example of Solow’s paradox? Arguably not. Far from underfilling the promise of productivity gains through automation, the cautious approach to automation in private capital markets seems to be due to three key factors:

- Complexity of integrating new systems into old, slow legacy systems

Many businesses and financial institutions are running back-office processes on ageing legacy systems. Such systems tend to need extensive and costly updates to keep them running, as research from IDC has detailed. We expect more and more institutions to reach the tipping point where they choose to take the plunge and upgrade to new and better systems, rather than keep investing in keep current systems in service. The performance gap between next-gen systems allowing automation and primarily manual legacy systems will continue to expand and will further incentivise this switch.

- Preference to ‘wait and see’

As with any new technology, it can take some time for the dust to settle and to see which approaches past the test of regular usage. This approach has its merits when very substantial capital outlays are required in order to simply test a new technology, but this characterisation is far from accurate for the capital markets technology solutions available today.

- Learning economies of scale for the institutional investment community haven’t yet been triggered

Economists have developed various models to explain how the diffusion of innovation progresses; arguably the most widely used is Everett Roger’s famous Diffusion of Inventions curve seen below.

Right now, capital markets automation is beyond the stage when only the visionary and excessively far-sighted were willing to adopt it. Innovators and Early Adopters, to use Roger’s categorisation, are already reaping the rewards of capital market automation. It is the Early Majority who are just starting to wake up to the potential of automation. This group typically place a lot of emphasis on learning from the results of the Early Adopters. As they do, and in the process reassure themselves of the strength of the value proposition represented by capital markets automation, the collective learning economies of scale will be enormous.

At Globacap, we are confident that the stage is now set for the rapid adoption of automation into private capital markets.