Creating a competitive edge: steps toward successful digitisation

This post is part of a series on The Digital Transformation of Private Equity: Unlocking Opportunities in Private Markets. If you’d like to download the full report, click here.

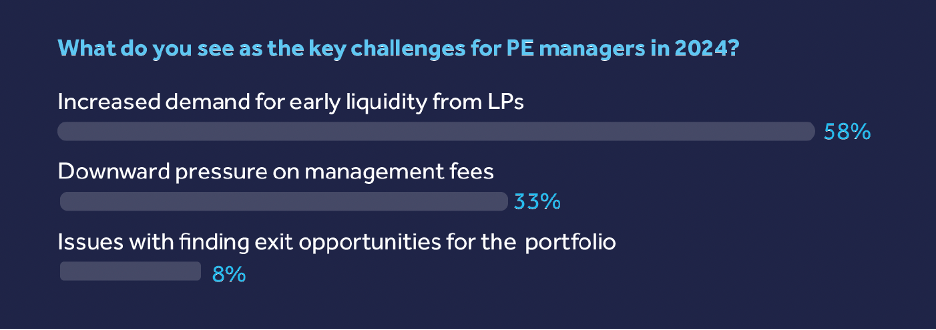

Private equity as an asset class is currently experiencing one of the most tumultuous periods in its history. Raising money for new investment vehicles is proving to be a long and arduous process for both emerging and established managers, as traditional investors (including family offices, fund of funds and pension schemes) retreat to more liquid asset classes or slow down their deployment until the global macro-economic climate becomes more settled. Simply put, this means that there are more PE firms chasing less capital and the balance of power, even for the highest-performing managers, has swung firmly in favor of investors.

Those investors are capitalising on this shift by exerting downward pressure on management and carry fees, as they look to hedge the illiquidity and uncertainty of private equity fund investing by ensuring that net fund returns are not eroded by high fees.

In an era when PE firms cannot guarantee that they will be able to replicate the levels of fee revenue they have enjoyed in past years, it is essential that they look to technology, and digitisation in particular, to compress manual processes and reduce their cost base. There are many advantages for PE firms that digitise their workflow.

These include, but are not limited to:

- Enhanced due diligence through advanced analytics and AI-driven insights

- Efficient trading and execution through digital platformsStreamlined settlement processes and reduced settlement times

- Real-time reporting and increased transparency

- Portfolio optimisation through data-driven decision-making

Building a successful digitisation strategy is imperative to meeting the demands of this rapidly evolving ecosystem. Revolutionising crucial aspects in the process such as reporting, investor relations, compliance and due diligence, and the digitisation of trading and settlement processes not only enhances operational efficiency but empowers firms to deliver superior value to their stakeholders. A step-by-step approach is possible, focusing on key areas to digitise and by implementing a solution that can handle the full end-to-end aspects of private markets.

Reporting insights

The reporting needs of private equity are vast, and they’re constantly growing. We’ve focused on three of the most essential areas for disruption; reporting for GPs, LPs, and regulators.

GPs need real-time insights

Information is power, and when PE firms have access to accurate reporting, in real-time, they can devise better strategies. One of the best ways to do this is by digitising the reporting process. By automating reporting, GPs have exactly the information they require whenever they need it, creating unprecedented efficiencies in PE. GPs can link all the portfolio companies’ systems together so that they feed into one platform. In a few clicks, GPs can view and compare inventory, production, purchasing data, sales statistics, and hundreds of other metrics33. It can also make life easier for portfolio companies as well. By plugging into the portfolio’s company systems directly, GPs gain instant visibility, without waiting to receive replies. What’s more, 61 percent of portfolio companies manually create presentations to report data to their GPs34 which is time that could be better spent on more

complex or strategic work.

LPs demand personalized visualizations

According to a 2022 study, 64 percent of LPs want online reporting that follows standardised formats35 . It’s an eight per cent increase from the year before and indicates that LPs expectations have changed since the pre- COVID tech boom. The way that they want the information to be presented is changing too, as LPs are tired of spreadsheets and steadily demanding real-time data visualisations.

However, the private market doesn’t have mandatory or standardised reporting practices, unlike its public counterpart, making life cumbersome for LPs as they try to grapple with the different documents of various GPs. At the time of writing, the regulatory reporting pressures on PE firms are fairly light, especially compared to banks, however, things are about to step up a gear as PE firms are bracing themselves for more significant regulation in the future. Along with this will come the need for faster and more accurate reporting which will only be truly feasible with automated technology.

” 83 percent of GPs noticed a small increase in due diligence controls in family offices, and 73 percent noticed the same trend among HNWIs “

Investor relations

One of the most taxing things for GPs today is keeping up with investor expectations. In a recent survey, one industry leader commented, “Coping with increased investor requests is now the most challenging aspect of raising a larger fund”. 36

Ensuring that investors’ needs are met is vital for the longevity of private equity. Today, around 75 percent of PE firms have an investor portal in place37, but often the platform can be cumbersome and old-fashioned. Even with this online system, many of the reports will still be drawn up manually and copy-pasted into the portal.

Lengthy and manual processes are no longer feasible, especially as investors become more accustomed to instant digital services in other areas of their life. PE firms seem to be aware of this, as over 50 percent are already in the process of implementing Customer Relationship Management software or CRM38.

Due diligence

Within the opaque world of the private markets, collecting the information needed for proper due diligence can be challenging. With no standardised reporting metrics, there is room for exaggeration, misinterpretation, or missing information. No matter how closely PE firms investigate, there will always be a risk of human error when it comes to manual due diligence.

The process usually takes between three to six weeks to complete39, however, against the current backdrop of sophisticated fraud, it could take even longer. 40 percent of PE managers believe institutional investors have ramped up their due diligence controls

“to a great extent” over the past three years40, even family offices and high net worth individuals (HNWIs) – who traditionally have a more relaxed approach– have been on the alert.

83 percent of GPs noticed a small increase in due diligence controls in family offices, and 73 percent noticed the same trend among HNWIs41.

More enhanced due diligence checks will soon become mandatory for EU firms and in a bid to open transparency and close tax loopholes, amendments to the AIFMD are currently being debated.

The increasing workload means PE firms that do things manually will spend more on resources but with limited results. Without some type of technology execution is slow and today, there are a growing number of solutions to help improve the speed and accuracy of due diligence.

Elsewhere in financial services, the business case for due diligence software is already well established. One study found that banks serving 10 million customers save up to 40 percent in costs by implementing technology to improve KYC processes42.

Modernising KYC and AML compliance

Anti-money laundering (AML) and Know Your Customer (KYC) checks are pivotal components of compliance for PE firms and in today’s landscape, their importance cannot be overstated.

Heightened regulatory scrutiny and evolving global standards make adherence to these checks imperative. The changing landscape necessitates agility in adopting new strategies and technologies to streamline these processes. Fortunately, technology has come to the rescue with solutions that remove the burden of manual work; artificial intelligence, machine learning, and data analytics are now indispensable tools in automating AML and KYC compliance. They not only enhance efficiency but also improve accuracy,

allowing firms to navigate the intricate web of regulations while effectively mitigating risks. Embracing these innovations is no longer a choice, but a necessity for firms aiming to thrive in this ever-evolving financial ecosystem.

However, regulation across AML and KYC varies hugely between jurisdictions, and it’s even more cloudy for alternative investments, especially on US-based investor and fund offerings. which adds complexity and costs. “It’s clear the AML and KYC landscape is ever-changing, and regulators are not always able to keep pace with its sophistication from rapidly evolving markets,”43 however there are solutions that aid in mitigating these challenges – complying with mandatory requirements that provide the educational tools and help fill compliance gaps where internal resources are sparse.

The aim overall is clear – to provide as much transparency in investing and adhering to requirements that ensure all organisations have the right processes in place to protect all parties.

Compliance & due diligence

PE has always enjoyed a lighter regulatory touch than mainstream banks and asset managers. The sector was left relatively unscathed after the 2008 regulatory overhauls, with just a handful of reporting requirements. While most banks were forced to double, triple, or quadruple their compliance departments to keep up, PE continued with business as usual.

Usually, firms serve asset managers, and institutional or accredited investors, so they neatly avoid compliance overhauls like MiFID II or MiFIR. In 2022 alone, the FCA charged banks over £215 million in fines for non-compliance44.

The tide, however, is turning. After a series of questionable PE takeovers – including those that led to the collapse of one of the UK’s largest department stores, Debenhams – legislative bodies are sharpening up. After all, Debenhams endured throughout two world wars, how could it not survive PE?

Regulation is coming…

Globally we’re seeing a rising wave of trends about to surround the PE landscape. Although each regulation individually may be manageable, the accumulation could become difficult for firms to meet – especially those with limited resources. Below, are just some of the regulatory sentiments in three key regions:

USA: SEC Amendments for Private Fund Reporting:

The SEC announced new reporting requirements for Private Equity in May 2023, with the first batch to be enforced by November, with private equity firms and hedge funds needing to submit45 certain reports with specific rules and requirements.

EU: Proposals underway for more transparency

The EU has also set its sights on closing tax avoidance loopholes, with more regulation on the horizon46. There are proposals to amend the Alternative Investment Funds Manager Directive (AIFMD), which currently regulates hedge funds and PE. There are requirements around greater transparency, changes around loans and liquidity, as well as more strenuous due diligence processes for PE firms.

UK: New regulations on the horizon…?

In 2022, the FCA published an open letter to alternative investment financial managers. “Overall standards of governance, particularly at the level of the regulated entity, generally fall below our expectations”47, it read. The letter continued to reveal that if firms employ significant leverage in transactions – such as those in private equity takeovers – there must be “commensurately high-quality risk management controls”. With this renewed focus, it seems likely that more regulations will come into play for PE firms over the next years. 40 percent of PE firms already confirmed that they were planning to increase the outsourcing of compliance functions in 202148.

Around the world, regulations are growing and shifting. And there are nuances between different jurisdictions. Keeping a finger on the pulse can be difficult for GPs, especially for larger ones that operate in several regions at once. With an average of 220 regulatory revisions to keep track of daily49 and more to come for the private funds industry, digital tools will relieve pressures for GPs and subsequently, LPs.

Digitising trading & settlement

Over the past decades public markets have enjoyed huge digital boosts. If private markets underwent the same digital transformation as public markets, could their value increase too? Absolutely. A recent study from Bite corroborates, with 79 percent of respondents agreeing that digitalisation has had a direct, positive impact on their organisation’s profit50.

So this raises the question, what could happen if private equity trades were as seamless as public markets?

The current process of clearing, settlement, and issuance can take days, or weeks to execute – it’s a critical cog, yet it remains frustratingly manual. Under the SEC, public market trades must be settled within two days51 and there are developments to speed it up to just one day. For PE, however, the process can take weeks, sometimes stretching into months.

Instead, by automating these checks and using specially designed software, something that is seemingly simple to execute and adopt hasn’t been the case until more recently, making processes much smoother, especially for firms working internationally.

This is where industry initiatives such as distributed ledger technology (DLT) and asset tokenization will reduce transfer times from trade execution to settlement, resulting in speedy and efficient operations, significantly reducing the settlement cycle, and essentially making settlement finality point and click. But first, the industry must focus on digitising the front, middle and back in-house processes.

Automated trading strategies like this are being employed via intelligent solutions that have the relevant safeguards and controls in place to manage the risk of large or unanticipated positions. There are automated tools, like Globacap, that have the right access to data that provides issuers with an overview to not only assess liquidity needs but also provide simple and effective avenues to secondary liquidity to its investors, providing much-needed transparency and accessibility in an opaque market.

With more rules coming into play for private markets that “if adopted, could lower risk to the financial system and drive greater efficiencies in the markets” says SEC Chair Gary Gensler52, being prepared for these changes via digital transformation is essential for PE firms.

33Source: KPMG (2018: Digital Transformation)

34Source: PwC (2022)

35Source: Private Funds CFO

36Source: Private Funds CFO Survey

37Source: Private Funds CFO Survey

38Source: S&P Global

39Source: Dealroom

40Source: Private Funds CFO Survey

41Source: Private Funds CFO Survey

42Source: International Banker

43Source: CSC AML and KYC Compliance report

44Source: FCA

45Source: Norton Rose

46Source: EY

47Source: FCA (2020)

48Source: Private Funds CFO49Source: Deloitte (Regtech 2023)

49Source: Deloitte (Regtech 2023)

50Source: Bite investments

51Source: Investopedia

52Source: SEC47Source: FCA (2020)